Cost of Defence 2015 launched

Posted By Mark Thomson on May 28, 2015 @ 12:00

[1]

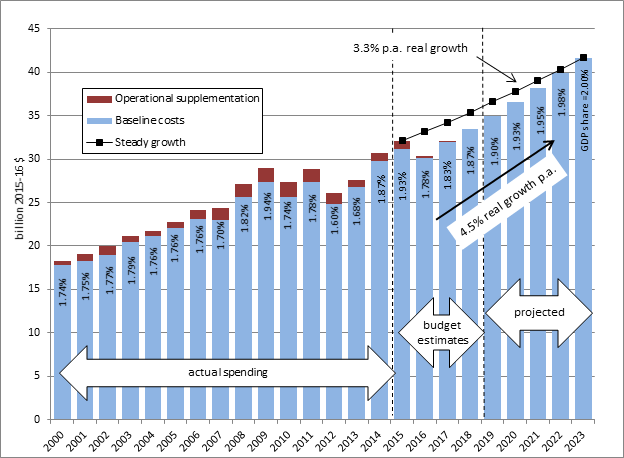

[1]On the morning after the Federal Budget I posted [2] a version of the above graph along with some basic numbers describing what’s going on. Today, my final analysis of the budget is launched [3]. Not much has changed after a fortnight. Nominal defence spending will grow by $2 billion next financial year (2015-16) to $32.1 billion, representing a year-on-year increase of 4.5%. As a share of GDP, defence spending will amount to 1.93% next financial year—but it would have been below 1.8% without foreign exchange supplementation and funding for deployments, and even less if nominal GDP growth met expectations.

At the time of the budget, I outlined a possible path to spending 2% of GDP consistent with the government’s promise. It involved annual real growth of 4.5% from 2018-19 onwards. But a smarter approach would be to start now with smaller steady annual increments of 3.3% real—shown as a black plotted line on the graph above. This would make it easier for Defence and industry to manage the growth. Indeed, it would defy common sense to cut the budget next year (as set out in this year’s budget) and then rebuild. Why make a difficult task more difficult than need be?

Of course, there are fiscal realities to be taken into account. This year’s budget saw the projected date of a federal surplus slip by twelve months, from 2018-19 to 2019-20. This constitutes a risk to defence funding, irrespective of when the government begins the climb up to 2% of GDP. There’s a binary political calculus about surpluses and deficits. At the moment, it’s easy to boost defence spending because the opportunity cost isn’t a foregone surplus. But later in this decade the choice could be between reneging on defence funding, or going to an election without having delivered a surplus. No prizes for guessing the outcome.

Taking the fiscal situation into account, it makes even more sense to continue increasing defence funding next year. Bringing investment spending (which is relatively mobile) forward from the end of the decade into the next couple of years could actually help the government achieve a surplus when the time comes. Of course, care would be needed to avoid creating unmanageable peaks and troughs.

Balancing defence funding with fiscal imperatives is only one of the challenges facing Defence and the government. To start with, there’s a White Paper to deliver. As we observed last year, 2% of GDP in the 2020s is a lot of money compared with the scale of Australia’s current defence force. Chances are that the White Paper will present an ambitious vision for the future force. Let’s hope that a planning process constrained by nothing more than an arbitrary fraction of GDP comes up with a sensible plan for the future. The risk is that proposals of lesser worth will make it over the line simply because money’s available. Defence’s planners certainly won’t be offering to hand money back.

There’s also a basket of technical issues to be resolved. It’s easy to promise that defence spending will be a certain share of GDP in a certain year. But foreign exchange movements and the vagaries of economic growth make it difficult to construct a funding model that does so without lumbering Defence with financial risk. Basing defence funding on a percentage of GDP means that future funding is contingent upon volatile changes in nominal GDP (which is linked to our terms of trade) and similarly volatile fluctuations in foreign exchange rates.

To cut a long story short, the sensible approach would be to fix a funding envelope with GDP share as a planning benchmark, and then adjust the envelope to ensure that its buying power is maintained against the buffeting of foreign exchange and inflation. An inflexible link to GDP share would be a disaster. On a year-by-year basis, it could equally flood Defence with cash it doesn’t need or deprive it of adequate funds to operate.

Apart from the White Paper and its (hopefully transparent) funding commitment, 2015 is set to be a big year for Defence. We’ve been promised a new Defence Capability Plan, a new Defence Industry Policy Statement, a new Naval Shipbuilding Enterprise Plan [4] and, at the end of the year, a decision on Australia’s next submarine. At the same time, Defence is about to undergo its second major reform program [5] in a decade.

Along the way there are several other challenges to be surmounted, including:

- Increasing the number of people in the ADF following four straight years of undershooting target levels by between 1,000 and 2,000 personnel, while lumbered with a controversial below-inflation pay outcome [6] for the force.

- Managing a major reform program, including a wholesale revamp of the capability development process while advising the government on two of the largest defence projects ever; the Future Submarine and Future Frigate.

- Rescuing the beleaguered $9 billion Air Warfare Destroyer project [4] while charting a long-term way ahead for naval shipbuilding, including the fate of the government-owned ASC.

Meanwhile, the ADF remains active in Afghanistan and its role in Iraq is expanding. It’s going to be a big year indeed.

Article printed from The Strategist: https://aspistrategist.ru

URL to article: /20707/

URLs in this post:

[1] Image: https://aspistrategist.ru/wp-content/uploads/2015/05/MT.png

[2] posted: https://aspistrategist.ru/budget-2015-a-good-one-for-defence/

[3] launched: https://www.aspistrategist.ru/publications/the-cost-of-defence-aspi-defence-budget-brief-20152016

[4] Naval Shipbuilding Enterprise Plan: http://www.minister.defence.gov.au/2015/05/22/joint-media-release-minister-for-defence-the-hon-kevin-andrews-minister-for-finance-senator-the-hon-mathias-cormann-air-warfare-destroyer-program-still-fixing-serious-legacy-issues-22-ma/

[5] major reform program: http://www.defence.gov.au/publications/reviews/firstprinciples/

[6] below-inflation pay outcome: http://www.minister.defence.gov.au/2014/11/03/assistant-minister-for-defence-adf-pay-offer-approved/

Click here to print.