China is back as Australia’s dominant export market

Posted By David Uren on June 19, 2024 @ 17:12

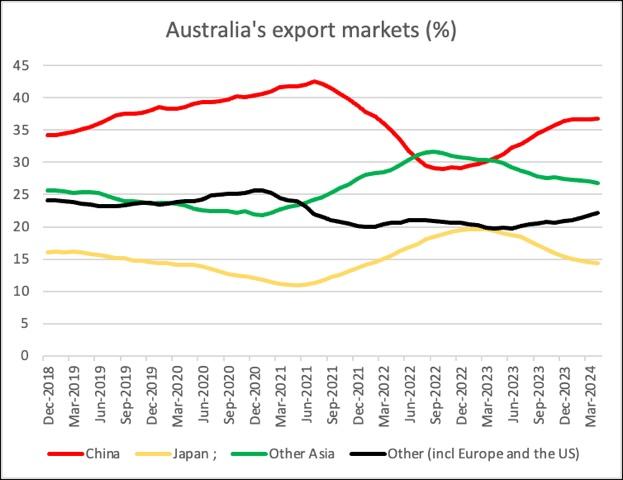

Australia’s exports to the nations that supported it during China’s three-year campaign of economic punishment are tumbling, as China reasserts its position as Australia’s dominant export market.

Exports to Japan have dropped by a third over the last 12 months, while exports to Korea are down by 23.9 percent and to Taiwan by 37.6 percent as Australian exporters of liquefied natural gas (LNG), coal, aluminium and other commodities redirect their sales to China. Sales to China, by contrast, surged 17.5 percent last year to surpass $200 billion for the first time.

Australia managed to ride out China’s series of export bans without suffering serious economic consequences because the flexibility of commodity markets brought support from other nations.

China’s share of Australian exports had peaked at an extraordinary 42.5 percent in the 12 months to July 2021. Its campaign against Australian trade was well under-way by then, having started with punitive anti-dumping duties imposed on Australian barley in May 2020 and followed by tariffs on wine and bans on coal in November of that year, however the impact of the bans had been offset by soaring iron ore prices.

By September 2022, China’s share of Australian exports had dived to 27 percent, the lowest level since 2013, as its purchases of Australian barley, coal, wine, oil seeds, cotton, zinc, nickel, gold, timber and crustaceans had dropped to zero.

China was still by far the biggest buyer of iron ore, wool, bauxite and a range of other commodities. Beef sales to China halved, but were not eliminated, while China emerged as the dominant buyer of Australian lithium during this period. However, the damage to the targeted industries threatened to be significant.

Australian exporters were saved by the other major Asian economies. Japan had been eclipsed by China as Australia’s biggest market in 2009 and its share of Australian exports had dropped from 20 percent to 11 percent by May 2021. But it stepped up its purchases of Australian goods. Coal sales to Japan doubled to $40 billion in 2022, with prices boosted by Russia’s invasion of the Ukraine, while sales of LNG almost trebled to $57 billion.

Japan was also a big buyer of other commodities. Its purchases of Australian barley, for example, rose by 85 percent in 2022 and a further 30 percent in 2023. In total, Japan’s share of Australian exports reached just under 20 percent by February 2023, the highest since 2010.

South Korea, Taiwan and India were also important in enabling Australia to minimise the effect of China’s economic coercion. South Korea’s share of Australia’s exports rose from 6.5 percent at the beginning of 2021 to peak at 9.0 percent in the 12 months to 2022. From a lower base, Taiwan’s share rose from 2.8 percent in calendar 2021 to surpass 5 percent in 2022. Exports to India showed a similar increase.

Opportunities to diversify were greater for Australian exporters of commodities like coal, cotton, barley and beef than was the case for wine. The heavy investment Australian winemakers had made in developing the Chinese market could not readily be duplicated elsewhere.

The election of the Albanese Labor government in May 2022 was followed by cooler rhetoric on China which gave Chinese authorities the cover they needed to start rolling back the export bans. The bans on Australian coal, in particular, caused economic damage to China, with difficulties in obtaining alternative supplies contributing to blackouts, while the use of inferior quality coals caused damage to blast furnaces in its steel industry.

China’s share of Australia’s exports started climbing again in early 2023 and by February this year, its share was back to 36.7 percent. The latest trade data shows some industries are still waiting to resume Chinese sales, including lobsters, timber logs and copper ores.

China’s gains are coming at the cost of Japan, South Korea, Taiwan and others who had stepped into the breach during the campaign of coercion.

Japan’s share of Australia’s exports dropped from 20 percent to 14.4 percent in the 12 months to April 2024, while South Korea’s share has fallen to 7.0 percent and Taiwan’s to 3.5 percent. Lower imports of LNG and coal are the main reason for the fall in their share of Australian exports.

All this underlines the attraction of China as the largest market for Australian goods and points to the failure of Australia to translate the slew of free-trade agreements struck through the 2000s into sustainable market gains.

There has been a much smaller but more sustained diversification in Australia’s sources of imports. China’s share of Australian goods imports peaked at 29.8 percent in the 12 months to April 2021 but had dropped to 25.2 percent over calendar 2023, where it has remained so far this year.

The rapid growth in sales of Chinese-made motor vehicles in Australia is being offset by slower growth or contraction of sales of telecommunications equipment, computers and screens, as well as many of the consumer goods that have long been sourced in China, such as furniture, prams and toys. Instead, Australian importers are buying more from South Korea, Singapore, Malaysia, Taiwan, India and Vietnam. Together, these countries now account for 21.6 percent of Australia’s imports, up from 14.5 percent in 2020.

It is a diversification that likely reflects concern about excessive concentration of supplies in a nation with which Australia has had unstable relations.

Article printed from The Strategist: https://aspistrategist.ru

URL to article: /china-is-back-as-australias-dominant-export-market/

Click here to print.