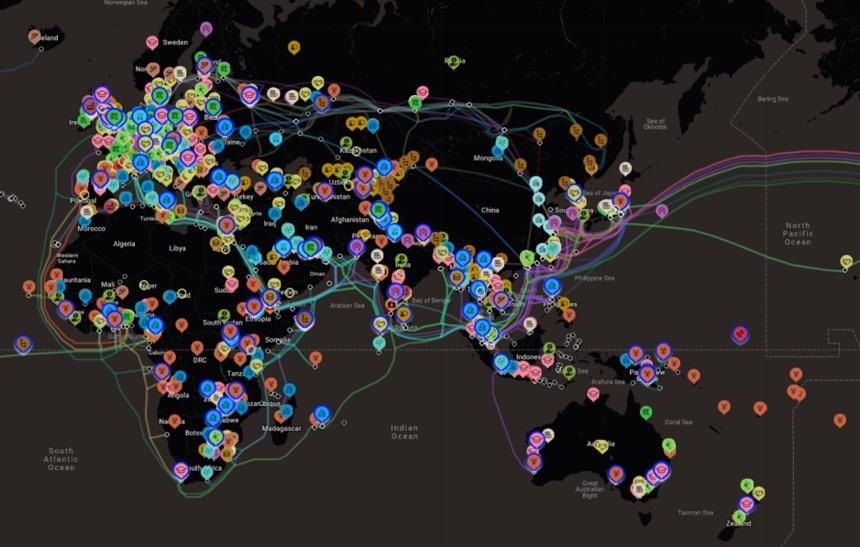

Mapping China’s Technology Giants is a multi-year project by ASPI’s International Cyber Policy Centre that tracks the overseas expansion of key Chinese technology companies. This data-driven project, and the accompanying database and research products, fill a research and policy gap by building understanding about the global trajectory and impact of China’s largest companies working across the internet, telecommunications, artificial intelligence, surveillance, e-commerce, finance, biotechnology, big data, cloud computing, smart city and social media sectors.

Today, we’ve relaunched our project with major data updates, new analytical products and two new reports. Here’s a summary of what you can now find on our website.

Data updates

Our China Tech Map now includes more than 3,800 global entries. These are each populated with up to 15 categories of data, totaling 38,000+ data points. With this relaunch, we’ve added four new companies to our database: Ant Group (digital payment and financial technology) Inspur (cloud computing and big data), Ping An Technology (AI, blockchain and cloud computing) and Nuctech (security technology).

Our data—which you can download here—includes many new entry types. For example, because of the pandemic, we’ve added a category focused on the companies’ monetary and in-kind donations to other organisations or countries. Alibaba, ByteDance and Tencent make up 80+ of the 130 Covid-19 donation entries we’ve mapped.

We’ve also looked into new or expanded areas of business, particularly those related to Covid-19. BGI, for example, signed a number of agreements to establish laboratories to improve Covid-19 testing capacity, such as in Angola, Australia and the United Arab Emirates. Elsewhere, it donated testing equipment, such as in Israel, Greece and Canada.

Smart city projects (often referred to as ‘safe cities’ by those selling the technology) featured heavily in our 2019 version of the China Tech Map project. We found that these continued to evolve globally, but also faced greater scrutiny in some countries. In Pakistan, Huawei projects in Islamabad, Lahore and Punjab all faced various political, technical and financial setbacks. Meanwhile, in 2020, Huawei signed an agreement to supply smart cities solutions to Saudi Arabia, while projects in Duisburg, Germany and Valenciennes, France appear to be ongoing.

New analysis products

When the China Tech Map project started, we assessed that the global expansion of China’s technology giants needed to be understood within the unique party-state environment that shapes, limits and drives their global behaviour. This, we argued, sets them apart from other large technology companies expanding around the world. This project has sought to:

- Analyse the global expansion of a key sample of China’s technology giants by mapping their major points of overseas presence.

- Provide the public with analysis of the governance structures, party-state politics, supply chain issues and the data ecosystem in which these companies have emerged, and are deeply entwined.

Our ‘Company briefs’ include new ‘Privacy policies’ and ‘Covid-19 impact’ sections. We’ve also updated each existing overview, and of particular note are updates to the ‘Activities in Xinjiang’ and ‘Party-state Activities’ sections. We’re also introducing a new product: ‘Thematic Snapshots’, which combine Company Briefs content across the four thematic areas named above.

New research reports

Finally, with this relaunch, we are publishing two new research reports.

Supply chains and the global data collection ecosystem

Computer networks have become essential to everyday life in many ways. So, when a cyberattack on a vital United States fuel pipeline or on Ireland’s health system causes massive disruptions, the world takes notice.

But a less obvious and more dangerous threat exists within business-as-usual data exchanges or when an adversary can control the direction of technological development. Then there’s no need for an ‘attack’; it’s simply a matter of turning on the tap. Our new policy report, Supply chains and the global data collection ecosystem, demonstrates how risks can emerge.

Most of the 27 companies tracked by our China Tech Map project are heavily involved in the collection and processing of vast quantities of personal and organisational data—everything from personal social media accounts, to smart cities data and biomedical data. Their business operations, and associated international collaborations, depend on the flow of vast amounts of data, often governed by the data privacy laws of multiple jurisdictions.

This report describes how Beijing—through expectations- and agenda-setting in laws and policy documents, and actions such as the mobilisation of state resources to set technology standards—is refining its capacity to exert control over the tech sector’s activities to ensure that it can derive strategic value and benefit from Chinese companies’ global operations.

Reining in China’s technological giants

Since the launch of our China Tech Map project in April 2019, the Chinese tech companies we canvassed have gone through a tumultuous period. Supply-chain vulnerability has ignited work in Europe, North America and other regions to reduce dependence on China. Telecommunications companies such as Huawei and ZTE that are deemed ‘high risk’ by multiple countries are increasingly finding themselves locked out of developed markets.

For China’s leadership, the twin crises of the Covid-19 pandemic and growing China–US strategic and technological competition highlighted the country’s need to achieve its long-held goal of ‘technological self-reliance’. But regulators in China have also used the Covid-19 pandemic as an opportunity to tighten supervision over Chinese tech companies, which over the past decade had grown into behemoths with relatively light regulatory oversight.

Reining in China’s technological giants describes the effects of these domestic and global developments on the 27 Chinese tech giants we cover on our map. This report argues that while the Covid-19 pandemic may have been a short-term boon to many of China’s technology giants (as it has been for technology companies around the world), for the Chinese Communist Party, the pandemic and the US–China trade war were a stark reminder of the country’s fragility in technological innovation.

Project aims

Through this project, ASPI ICPC is seeking to contribute to a greater understanding of what is taking place as it relates to the global expansion of China’s tech giants. Through extensive data-driven analysis, this project also articulates the reasons why governments, business and civil society should care about, and respond to, these developments. We also hope to stimulate debate on how the public and private sectors should respond.