Most discussions of ‘near-peer’ conflicts in the modern context include some reference to both a ‘resurgent Russia’ and a ‘rising China’. We thought it’d be interesting to compare the navies of the two nations as a case study of broader trends in their defence modernisation efforts. Similar analyses could be conducted for other military branches, but an abundance of open-source data on naval assets and the maritime nature of the Asia–Pacific theatre make navies a sensible place to start.

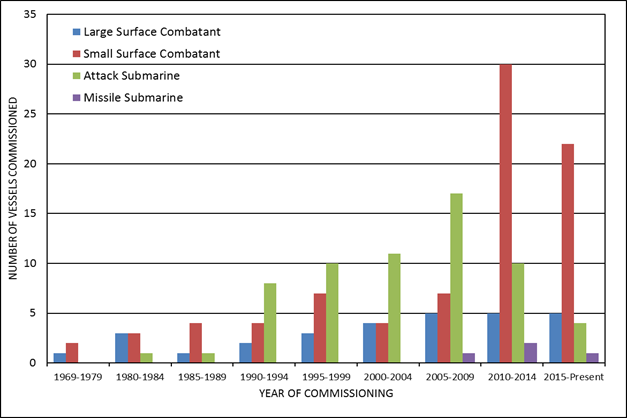

Figure 1 charts the age of the vessels currently in service with the Russian Navy, separated by category. The ‘large surface combatant’ category includes Russia’s sole aircraft carrier, the Admiral Kuznetsov, and the ‘missile submarine’ category includes both nuclear-armed SSBNs and conventionally-armed SSGNs. (We omitted three ‘special purpose’ submarines.)

Figure 1: Age of the Russian Navy

It’s immediately clear that most vessels in service were built in the waning days of the Cold War; roughly two-thirds of Russia’s current surface combatants and submarines were commissioned between 1985 and 1994. There’s been a recent flurry of activity, but at well below Cold War levels.

Of 21 surface combatants delivered since 2000, 17 are corvettes and four are frigates. Further frigate construction efforts have been hampered since 2014, when Ukraine ceased exporting naval turbines to Russia in retaliation against Moscow’s role in the Crimean crisis. The Russian Navy will be lucky to receive another four frigates by the end of the decade.

Retaining large surface combatants in the fleet has depended on efforts to upgrade and sustain old Soviet-era ships. And Russia’s ambitions for the construction of a new large surface combatant (Leader-class) in the 2020s may never be realised, especially if economic conditions don’t improve.

Russia has commissioned just seven diesel–electric submarines (SSKs) since the end of the Cold War. Problems in the first Lada-class boat (Sankt Peterburg, 2010) resulted in production being suspended after just one launch. The remaining two are expected for completion by 2019, after which a new class is planned. To fill the SSK gap, the Russian Navy accepted six ‘Improved Kilo’ submarines between 2014 and 2016. Foreign sales of the Improved Kilo have provided steady work for shipbuilders: 18 boats have been delivered to foreign navies since the late 1990s.

Nuclear-powered attack submarine (SSN) production has been more troubled: since the last of 10 Akula-class SSNs was commissioned in 2000, only one new SSN has entered service: the Severodvinsk (Yasen class). The new submarine was so plagued by problems that the second boat in the class is designated as a new sub-class (Yasen M), and is expected to cost twice as much as the first. The new Borei-class SSBNs have been very successful by comparison: three were delivered in 2013–14, and another six are planned for completion by 2020.

As noted on The Strategist back in November, Russia’s trying to reconcile its plans for significant military modernisation with the harsh economic realities of low oil prices and continuing sanctions. Figure 1 paints a picture of a country that’s struggling to restore its naval industry to even a shadow of its Soviet-era glory.

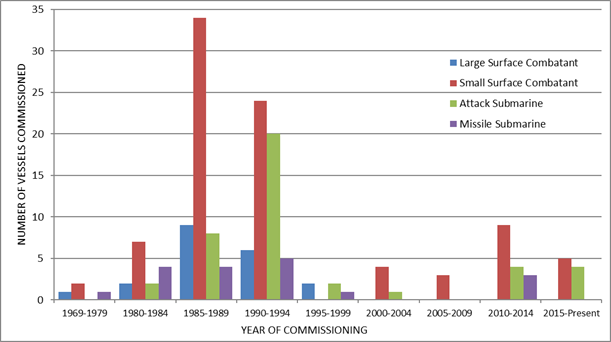

China stands in stark contrast to Russia’s shipbuilding struggles. Spurred on by its economic growth and a growing maritime consciousness, China’s been building ships at a frenetic pace. Figure 2 shows the pace and scale of the growth of the People’s Liberation Army – Navy (PLAN).

Figure 2: Age of the Chinese Navy

Most of China’s recent builds are surface vessels of various sizes. Since 2000, China has built 19 large surface combatants (destroyers and aircraft carriers) and 63 small surface combatants (frigates and corvettes). Of the 124 surface vessels currently in service, 53% have been built since 2010, at an average of almost nine surface vessels commissioned per year. The PLAN has invested heavily in corvettes to replace its fleet of ageing coastal patrol craft, as well as larger air warfare vessels to enhance its ability to counter airborne threats—an area in which the PLAN has been deficient for decades.

Interestingly, the PLAN’s submarine fleet is adding vessels at a much slower pace. The bulk of its SSKs were built in the 1990s and 2000s, while its SSN and SSBN boats are coming back online after a production pause. While the exact cause or causes of the pause are unclear, it’s likely that they were to either implement new features into the design (the likely addition of a vertical launch system to the Type 093A), or to remedy known defects (China’s nuclear propulsion systems are notoriously underpowered). What’s clear is that China isn’t putting all its eggs in the nuclear-powered basket, as it’s continuing to build SSKs along with SSNs and SSBNs.

The data shows that China is modernising at an incredible rate, and that trend doesn’t appear to be slowing much. Reports suggest that a further eight Type 052D destroyers are to be built by 2020, along with the completion of China’s next aircraft carrier and the continuation of the Type 056/056A corvette line. That’s probably just a taste of what’s to come, although shipyard overcapacity (and subsequent consolidation) mean that it’s unlikely that PLAN shipbuilding will reach the heights seen in the 2010–2014 period.