The organisational reforms to defence acquisition that followed the First Principles Review were extensive. Cassandras that we are, at the time we worried about the risk of a ‘perfect storm’ of deteriorating external strategic circumstances, internal organisational disruption, an extensive backlog of unapproved projects and an aggressive forward program of large development projects to be steered through government approval and into the project management phase. We thought that the most likely outcome was a badly lagging investment program, with concomitant delays in the delivery of capability to the ADF.

It’s now getting on for two years since the release of the 2016 defence white paper and its associated integrated investment plan, and patterns are emerging. We don’t have as much data as we’d like because the government has abandoned the long-standing practice of disclosing the projects it has approved. But it looks like things are already behind schedule; there are simply too many projects that were slated for approval about which nothing has been said.

Significant if not substantial delays wouldn’t be surprising. The target of 10 first-pass and 23 second-pass approvals in 2016–17 was well above the annual average of 6.8 first-pass and 11.5 second-pass approvals for the preceding 12 years. And things are only going to get more difficult. In 2017–18, the target is for 20 first-pass and 37 second-pass approvals. Such was the ambition of the 2016 white paper.

Nevertheless, we must concede that approvals are proceeding at a faster than usual pace. And it’s not just smaller projects—progress is being made on some of the largest and most expensive defence projects ever contemplated by Australia.

But we’re mindful of the old catchphrase of dodgy tailors, ‘Never mind the quality, feel the width’, so it’s worth looking at the quality of some of those decisions. And there are good reasons to worry about that; the acquisition reforms of the 2000s were mostly about taking the time to get things right before approval, rather than rushing into poorly conceived projects and wearing the delays and cost overruns that often result.

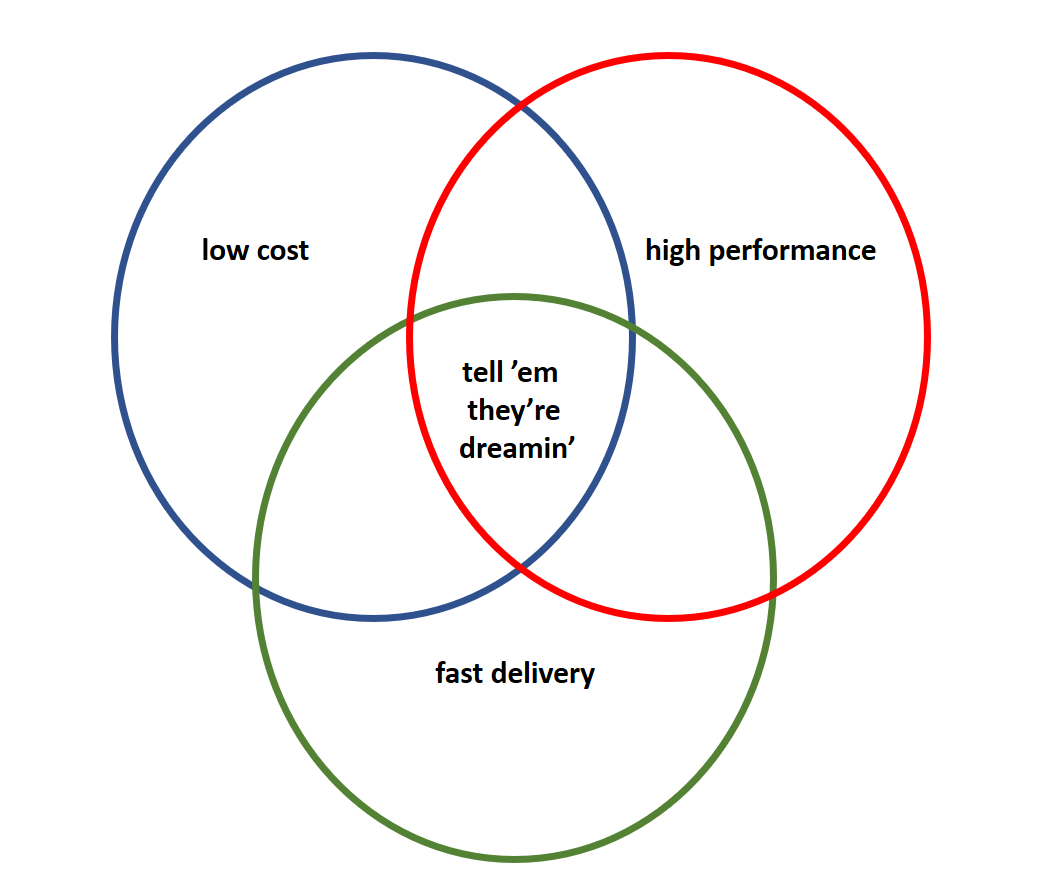

It has long been a tenet of project management that you may pick only two of the three variables of fast delivery, high performance and low cost. Here’s what one of us said earlier this year about the balance being struck in current defence planning (the benefit of being a professional doomsayer is that you’re bound to be right about something):

While the new arrangements appear to have led to a surge in project approvals … the acceleration has been achieved by adopting a different trade-off between time and risk. Under the old system, we expended time to reduce risks. Now we accept greater risks to save time. While today’s [strategic] challenges justify greater risks in procurement, it would be penny wise and pound foolish now to short change the management of the initial stages of the costly and militarily critical projects now being developed.

A few examples show how the balance between risk and expeditious approval has shifted. And, in some cases, they illustrate how uncertainties that would previously have been sorted out prior to approval are now being left for afterwards. Probably the most visible programs—and therefore closest to the heart of our political masters—are in the naval shipbuilding sector. And, true to its word, the government hasn’t let the grass grow under its feet. It has approved the selection of the combat system (actually systems, plural) for the future frigate and, most recently, the design of the new offshore patrol vessels (OPVs) and the arrangements for building them. For different reasons, both of those decisions reflect immaturity in the program design at the time of approval.

One of the early lessons we learned in this job is that once the government has made a decision, there’s little to be gained from saying ‘This is nuts’. Instead, the constructive thing to do is to explain the context of the decision, identify the benefits the government expects to gain, and point out any challenges for implementing the decision. So, in the spirit of being constructive, we’ll just say that there will be no shortage of interesting implementation challenges in the OPV program. The approved model requires the German ship designer to work with three Australian shipbuilders at two different sites. Given the difficulties (read ‘years of delay and billions of dollars of cost overruns’) the air warfare destroyer project ran into in translating a Spanish frigate design into local production practices at one yard with one local builder, that’s a bold move. We’re not at all sure how it will work, or even who will do what. But one thing is certain: when the government takes it upon itself to dictate industrial partnerships, it substantially shifts the onus of responsibility for success or failure back onto the Commonwealth.

Turning to the future frigate combat system, the decision to use a hybrid of the US-sourced Aegis system and Saab Australia’s 9LV is a good one. A previous ASPI analysis explained how that approach could lead to a world-class capability outcome. But it also cautioned that ‘[b]efore heading irrevocably down that path, some rigorous systems engineering work that follows on from the existing risk reduction work is required’. Again, there’s been no explanation of how the systems will fit together, and it seems that many of the details are still to be sorted out—even at the level of who will be responsible for what. The approval actually seems to have been for serious work to begin on system design. In other words, risk reduction steps that might’ve occurred prior to approval under the Kinnaird model of acquisition that held sway from 2003 until 2015 will now occur after the fact.

And it’s not just us having trouble understanding what’s going on. We’ve discussed these examples and other recent approvals with a range of industry players—including both successful and unsuccessful bidders—and we often find that they’re also scratching their heads. Because the government is a monopsony buyer, defence contractors are naturally reluctant to be openly critical of a decision, usually having their eye on future competitions. So only rarely will dissent be made public. That makes the negative industry response to the decision on the army’s ground-based air defence system more noteworthy. We won’t delve into the entrails of the decision here, other than to note that it was a sole-source decision when there seemed to be several credible contenders for the contract. The process was expedited under Defence’s ‘smart buyer’ model, whereby low-risk acquisitions can bypass the usual competitive models. Defence (and the minister for defence industry) say that the decision meets the criteria of being straightforward and low risk. But there’s a widespread view that the preferred ‘short cut’ involves substantial developmental work.

Some or all of the decisions we’ve discussed here might turn out to be corkers. We’d dearly like to be proved wrong, but we think the shift in thinking that’s occurred is worth noting. Rapid decisions have sometimes worked well in the past—such as the procurement of F/A-18 Super Hornets and C-17 transport aircraft—but they were off-the-shelf purchases from long-established production lines. We’re in unknown territory when applying the same ‘damn the torpedos’ approach to bespoke acquisitions involving complex systems integration and greenfield industrial start-ups.