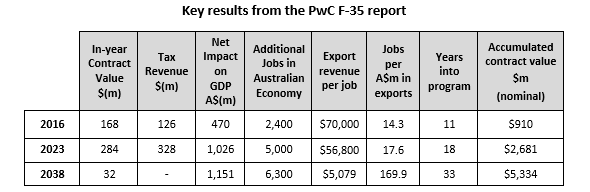

Back in March, the Minister for Defence announced the results of a study of JSF-related exports by PwC. She said that the ‘Joint Strike Fighter program will create 2,600 extra defence industry jobs by 2023, more than doubling the current associated workforce of 2,400.’ Given that total export contracts with Australian firms under the F-35 program amount to only around $910 million over 11 years, they’re encouraging numbers.

In comparison, we’ve been told that the $50 billion Future Submarine project will produce around 2,800 direct and supply chain jobs, and the $35 billion Future Frigate program will produce around 2,000 direct jobs. It’s little wonder that the Prime Minister, Treasurer and Defence Industry Minister have since joined the chorus singing the praises of JSF-related exports.

The PwC report highlights the results for 2016, 2023 and 2038 (see the table below). All US dollar contract figures have been converted to Australian dollars assuming 1AUD = 0.75USD.

The PwC report provides detailed results which can be averaged over the duration of the program. It predicts more than 24 jobs for every $1 million of JSF-related exports across the program’s 33 years. That corresponds to average export revenue of just over $41k per job. To put that in context, a survey of recently announced job figures for a range of defence projects (see the forthcoming ASPI Budget Brief) reflects expenditure per job created of $400k–500k, which is ball-park commensurate with the roughly $440k revenue per employee in the Australian manufacturing sector.

Clearly an explanation is called for.

The first difference between the government’s other announcements and the analysis by PwC is that the former are desk-top estimates of mostly direct jobs, whereas the latter employs what’s called a Computable General Equilibrium (CGE) model. So it’s not an apples-to-apples comparison.

I don’t pretend to understand the technical aspects of GCE modelling, but here’s what I know. Rather than just looking at direct and supply chain jobs, a GCE estimates the impact across the Australian economy. In so doing, CGE models take account of (1) the reallocation of resources and flow-on activities within the economy, and (2) the additional economic activity resulting from labour income.

If all we had was the PwC report, we might conclude that the higher rate of job creation simply reflects better modelling. We might even extrapolate and conclude that the government is underselling the economic benefits of its ‘buy Australian’ defence industry policy. But we have another data point.

As it happens, Defence produced an economic impact analysis of building submarines in Australia in 2015, also using a GCE model, which was released under FOI. It’s based on spending $15.1 billion over 16 years to build six Collins-like submarines. It found that the Australian economy would be $65 million per annum larger for the 16 years of the project, and predicted an additional 733 jobs would be created for the duration of the project. That’s despite assuming 1,000 direct and 1,900 indirect jobs.

To be clear, the submarine study says that of the 2,900 assumed to be working on the project, 2,200 of those people would have found work in other industries that were ‘crowded out’ by the decision to build locally. With a net employment forecast far below the government’s figures for the future submarine project, it’s easy to see why it was only released under FOI.

The modest net job creation predicted from submarine building deepens the contrast with the F-35 exports study. Averaging over each program, the submarine study predicts 733 net additional jobs from average annual expenditure of $938 million, while the F-35 study predicts and average of 3,939 jobs from average annual exports of only $162 million. Taken together, the two studies imply that every dollar of defence exports generates 32 times more jobs than a dollar spent building defence equipment in-country.

Even though both studies use a GCE model, there’s a significant difference between the two situations. While the submarine project requires additional taxation to fund the build, JSF-related exports don’t. Because CGE models take account of taxation, that may help explain the very different results. Indeed, all other things equal, additional taxation will subtract from economic activity. Other factors that might be relevant are the differing geographic locations of the two programs—SA versus mainly VIC and NSW—and differences in the calibration and implementation of the GCE models.

Taken at face value, a renewed emphasis on defence export facilitation and global supply chain agreements is called for. In some circumstances, the maximum economic benefit might be gained by foregoing domestic production in favour of securing access for local firms into global supply chains. Remember, the F-35 exports only came about because we’re purchasing the aircraft from US factories. If we’re going to use defence spending to grow the economy, let’s get the most out of it.

Of course, two isolated studies are a fragile basis on which to build a policy. Without further work, we can’t be sure how much of the difference between the two studies comes from the export nature of the F-35 program, as opposed to other differences in what was modelled, and how the modelling was conducted. Indeed, without independent replication, we can’t be sure that either study is correct.

As a priority, the government should commission CGE modelling to properly and systematically determine how Australian defence spending can best be harnessed to create jobs and grow the economy—including through both exports via global supply chains and local production. A good first step would be to have a third-party replicate the 2015 submarine and 2016 F-35 economic impact studies on a common CGE platform. Only then might we be able to properly understand what’s behind the dramatically different results.