The Pentagon’s recent decision to freeze small grants to Australian rare-earth miner Lynas and its US rival MP Materials highlights the difficulty of breaking China’s stranglehold on the global supply of critical minerals.

Despite years of angst-driven US government reviews and presidential directives aimed at securing vulnerable defence supply chains, the US political system has had enormous difficulty in delivering targeted investment support to anything but the very largest of businesses.

Long-established firms like Boeing, Lockheed Martin and Raytheon gain vast public backing for defence-related projects, but support for smaller firms is seen as ‘picking winners’ and best left to the market and venture capitalists.

The Pentagon only announced its grants in late April, declaring they would ‘mitigate US reliance on China for rare earth minerals’ in line with the wishes of Congress and President Donald Trump.

But the Pentagon beat a hasty retreat at the first sign of political grapeshot, telling the firms that the grants had been ‘put on hold until further research can be conducted’.

Reuters reported that the funding was suspended after the US Department of Energy expressed concern about Chinese influence in MP Materials and discontent arose among Republican senators about support being offered to Lynas, as a non-US company. The group of senators has proposed legislation that would restrict any future funding solely to US-owned firms.

Congress is a broking house for vested interests and no proposal ever comes to fruition on the floor without horse-trading and deals. Support for small ventures is perennially vulnerable to being picked off by individual constituencies. The intervention of a Wyoming senator who wanted backing for a rare-earth start-up in his own state may have helped to cruel the Pentagon grants.

MP Materials and Lynas are the only non-Chinese rare-earth miners of any scale. China controls 80% of global rare-earth production and up to 100% of many of the stages of downstream processing and manufacturing. It also has a large share in global production of other critical minerals, including tungsten, graphite and vanadium.

China’s Shenghe Minerals has a 9.9% stake in MP Materials and an offtake agreement to process its raw materials. It was seeking Pentagon assistance to restart processing in the US.

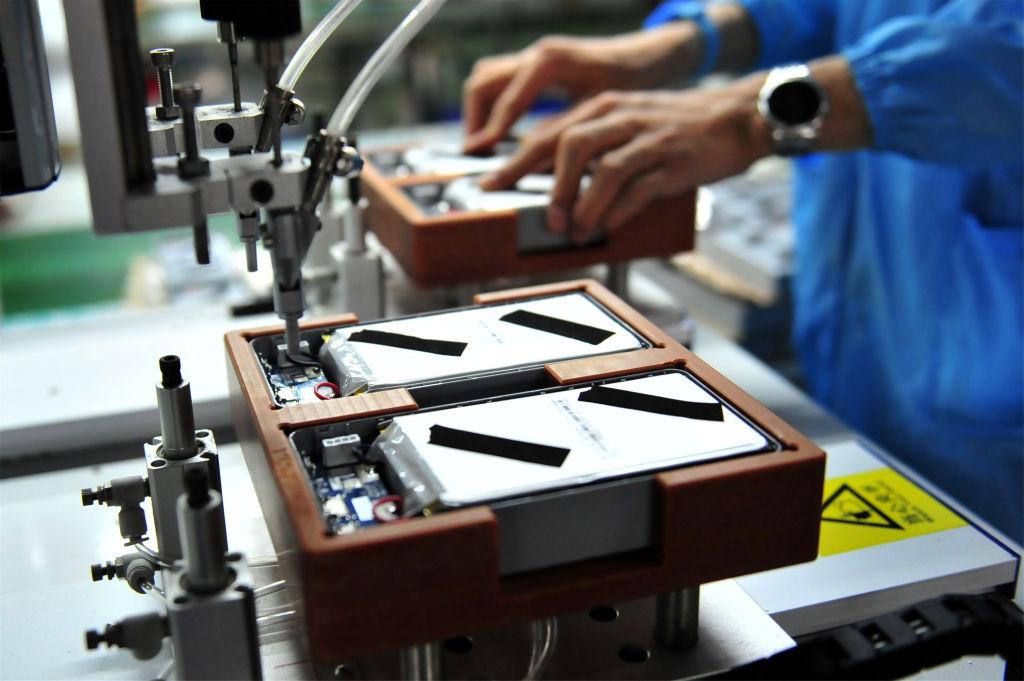

Lynas wanted Pentagon support for a joint venture with Texas chemicals firm Blue Line to establish a processing plant for ‘heavy’ rare earths, which are crucial for permanent magnets operating at high temperatures, such those used in guidance controls for missiles. There is currently no processing capacity of any scale for these minerals outside China.

The size of the grants wasn’t disclosed, but the offer was small for both firms, intended simply to help establish feasibility. Lynas told the ASX that the suspension of funding wouldn’t have a material impact on its result.

It’s possible the program will resume—the Pentagon has proposed legislation which would increase the available funding for rare-earth projects to US$1.75 billion. However, US officials continue to point to the need for ‘market-led’ solutions to the national security concerns created by China’s hold on critical minerals.

A new report by Perth USAsia Centre’s Jeffrey Wilson argues that the market will not cure the supply-chain vulnerabilities for many of these minerals because the risks are too high.

Rare earths raise extreme technology risks, as each deposit requires a bespoke approach to extraction. Because pilot plants don’t necessarily reveal the problems that occur in full-scale operation, full development funding is required before a technology is proven. But that funding is hard to obtain without a secure offtake agreement and it’s hard to lock in customers before the technology is established.

Project promotors must also deal with elevated political and market risks. Because supply is monopolised, there’s a danger that any new entrant can be driven out of the market by predatory pricing. The potential for minerals that are critical to defence supply lines to be used as a political weapon introduces a level of uncertainty for investors.

Prices for many critical minerals have been highly volatile, soaring at times of tension or shortfalls in supply but then languishing for decades at unprofitable levels. China’s production is dominated by state-owned enterprises which are less responsive to market forces.

Wilson says there’s also a social risk. Much global production of critical minerals has had damaging environmental effects and, in the case of several nations, used child labour.

While critical-mineral strategies intended to overcome dependence on China have been developed by governments in the US, Europe, Japan and Australia, the only tangible result has been the Japanese funding of Australia’s Lynas in 2010.

Wilson argues that too much attention has been given to information-sharing and not enough to tackling the barriers to investment and providing material financial support. He says there has also been excessive emphasis on the supply of raw materials, rather than on the integrated value chain that includes processors and manufacturers.

There’s no point being able to produce non-Chinese rare-earth oxides if they still have to be shipped to China to be turned into metal and then into magnets. It’s also the case that to get a rare-earth project going requires not only capital funding but also committed customer support. Customers may need financial incentives to switch to a non-Chinese supplier.

‘Integrated approaches, which adopt a whole-of-value-chain perspective and promote the development of both upstream extraction and mid-stream processing, will be needed to properly secure supply’, Wilson says.

The biggest stumbling block, as has been shown by the Pentagon’s timidity, is that governments are no more willing to take on elevated financial risks than the private sector.

In 2010, the Japanese government was prepared to risk US$250 million backing Lynas and has stuck with the company through torrid times as it tried to get technology working and fended off attempts to force the closure of its Malaysian processing plant.

But no other government has been prepared to help any of the dozens of companies with promising critical-mineral deposits bring them to fruition. The dependence of military supply chains on China for critical materials will continue until this changes.