Foreign collaboration continues in China’s drive for technology self-reliance

Posted By Rebecca Arcesati on September 14, 2022 @ 12:00

For decades, China’s government has been tapping into foreign inputs and knowledge to close gaps in its national innovation system. As the political project of breaking China’s foreign technology dependencies becomes more important for Beijing, so too does the need for policymakers in Europe and elsewhere to understand and assess these connections.

For China’s ambition of industrial self-sufficiency in chip production, photoresists are a major headache. These light-sensitive materials are essential for the global semiconductor industry. In lithography—the process by which information contained in a design is encoded into patterns of a wafer—circuit features form after wafers are coated in photoresists. A handful of Japanese companies control [1] 90% of the global market for these materials, making Chinese companies highly reliant on imports.

As John Lee and Jan-Peter Kleinhans write [2], photoresist development is prioritised in Chinese central and local governments’ industrial policy plans. National funding for research and development has helped some companies make some inroads at the lower ends of the value chain. But getting closer to the cutting edge within the next five to 10 years is an unlikely prospect.

In December, Shanghai Sinyang Semiconductor Materials signed a memorandum of understanding with Heraeus Group, a German company that makes ultra-pure specialty chemicals required for photoresist production. Heraeus will provide material and technical support to the Chinese partner’s development of photoresists. Beyond photoresists, Heraeus’s Shanghai innovation centre aims [3] to ‘introduce world-leading technologies to lay a solid foundation for local production’ of third-generation semiconductors.

This is just one example of how partnering with a foreign company can provide the Chinese industry with helpful products and know-how as it marches towards indigenisation in strategic sectors earmarked by government policy.

Like other domestic players, Shanghai Sinyang is striving to ‘break the foreign monopoly of integrated-circuit high-end photoresists’, a Chinese securities media outlet reported [4]. In the first quarter of 2021, the publicly listed company invested [5] 14.56% of its revenue in R&D. Its self-developed KrF (248-nanometre) thick-film photoresist has already won its first order, and the company expects to commercialise the ArF photoresist needed to produce smaller chips in 2023.

In another case, German manufacturing and technology giant Siemens has been training [6] China United Heavy-Duty Gas Turbine Company (UGTC) to develop and produce heavy-duty gas turbines. A subsidiary of the state-owned State Power Investment Corporation, UGTC can tap into Siemens’ technical experience in design, engineering and testing ‘in support of China’s goal to independently develop and build an own heavy-duty gas turbine’, according to the first MoU [7] signed in 2018. The State Power Investment Corporation is the implementing unit [8] of a dedicated national science and technology funding megaproject.

Because they are extremely hard to make, heavy-duty gas turbines are among China’s 35 strategic import dependencies described in a series of articles published by a newspaper run by the Ministry of Science and Technology, translated and analysed [9] by the Center for Security and Emerging Technology. These ‘chokepoints’ are a major preoccupation for a Chinese leadership increasingly worried about export restrictions from the US and its allies.

The two cases have important differences—supplying inputs upstream is distinct from training a company to reproduce a technology, and power generation doesn’t have quite the same national-security implications as chip fabrication.

However, both illustrate the complex interplay between foreign inputs and R&D collaboration and their role in building up indigenous capabilities. The process is nudged along by government industrial policy in China’s larger technology innovation strategy. This is especially true in strategic sectors in which ‘key and core technologies are controlled by others’, as Chinese President Xi Jinping often laments [10]. Each of these ingredients is critical in achieving the political goal of technology self-reliance.

For foreign companies across many industries, China is a key market. In Siemens’ case, China is a market of last resort as gas turbines are being replaced [11] by renewable power generation. Market access is one reason European companies have been deepening their ties with China’s innovation system, disproving [12] simplistic narratives about ‘decoupling’ between China and the West. Another reason is the attractiveness [13] of the country’s local innovation hubs, especially in emerging technology fields like artificial intelligence.

Despite the clear advantages for China’s research partners, whether multinationals or research institutions, it is particularly in emerging technology areas that the costs and benefits of supporting China’s state-led tech indigenisation efforts are becoming both more difficult and more urgent to assess.

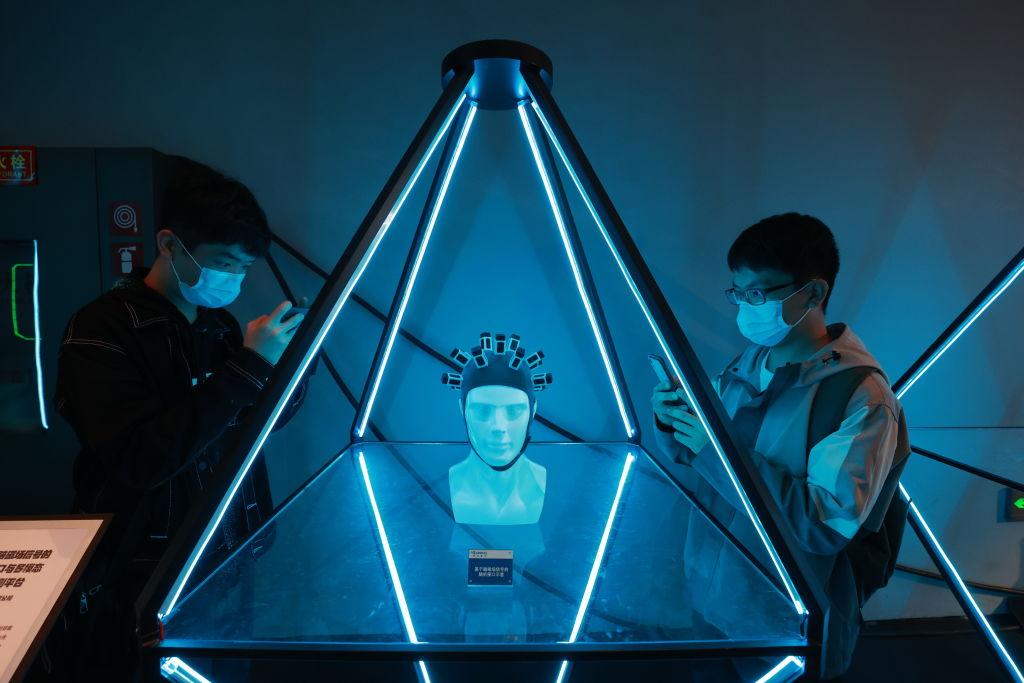

Among the results showcased [14] at the 2019 Sino-German Technology and Innovation Cooperation Conference was a joint research endeavour in AI and brain science, led by the Technische Universität (TU) Berlin and Northwestern Polytechnical University (NPU). Researchers made a technological achievement in the application of brain–computer interfaces to drone swarming and flight control.

NPU, one of the ‘Seven Sons of National Defense’, is subordinate to the Ministry of Industry and Information Technology and engages in classified military research [15]. The US Industry and Security Bureau has been mulling [16] export controls on brain–computer interface technology. However, Chinese AI–brain research is already progressing rapidly [17], also thanks to long-term government planning and investment [18].

It’s impossible to know the full extent to which the partnership with Professor Klaus Obermayer of TU Berlin, launched in 2002, might have contributed to the People’s Liberation Army’s advances in military applications of AI–brain technologies. The accomplishments NPU lists are certainly remarkable:

… signed eight international cooperation agreements; jointly established the Shaanxi Provincial International Joint Research Center for Brain–Computer Integration and Its Unmanned System Applications and the Sino-German Joint Laboratory of Neuroinformatics of Northwestern Polytechnical University; completed more than 20 scientific research projects; and undertook postgraduate teaching tasks and joint training; … published more than 60 papers, was granted or filed over 20 Chinese patents, won 16 awards, and trained more than 200 graduate students.

Although the Shaanxi provincial government’s website says [19] that research conducted in the two joint facilities mentioned above is aimed at applications like healthcare and disaster relief, it bears remembering that NPU supplies drones to the Chinese military and hosts a dedicated defence lab.

I’m not suggesting that European stakeholders should halt their research and innovation cooperation with Chinese partners across the board. In an era of globalised value chains, policymakers should be extremely selective when considering restrictions on cross-border technology flows: overly broad controls can damage innovation, scientific progress and Europe’s industrial competitiveness. That China is catching up in soon-to-be legacy technologies like gas turbines is hardly a threat to European economic interests. Besides, foreign inputs are only one ingredient of China’s indigenous innovation strategy: domestic entrepreneurship and industrial policy matter greatly.

However, the role of foreign R&D collaboration in supporting China’s self-reliance drive warrants much closer scrutiny in countries like Germany whose long-term competitiveness could be at stake. That’s not to mention national security, which partnerships like that between TU Berlin and NWPU clearly endanger.

Article printed from The Strategist: https://aspistrategist.ru

URL to article: /foreign-collaboration-continues-in-chinas-drive-for-technology-self-reliance/

URLs in this post:

[1] control: https://asiatimes.com/2021/09/a-big-deal-for-the-future-miniaturization-of-chips/

[2] write: https://merics.org/en/report/mapping-chinas-semiconductor-ecosystem-global-context-strategic-dimensions-and-conclusions

[3] aims: https://www.heraeus.com/en/group/innovation/press_and_news_1/2020_4/innovation_center_shanghai_interview.html

[4] reported: https://archive.ph/QtF98

[5] invested: https://new.qq.com/omn/20210817/20210817A030TA00.html

[6] has been training: https://archive.ph/ltGG4

[7] first MoU: https://press.siemens.com/global/en/pressrelease/siemens-and-spic-explore-technology-collaboration-heavy-duty-gas-turbines

[8] implementing unit: http://www.spic.com.cn/2021/cygl/?type=8

[9] translated and analysed: https://cset.georgetown.edu/publication/chokepoints/

[10] laments: https://digichina.stanford.edu/work/xi-jinping-strive-to-become-the-worlds-primary-center-for-science-and-high-ground-for-innovation/

[11] are being replaced: https://www.reuters.com/article/siemens-china-gas-idUSL8N21D1IR

[12] disproving: https://www.bloomberg.com/news/articles/2022-08-17/china-s-lure-for-european-companies-outshines-flaring-tensions

[13] attractiveness: https://w1.siemens.com.cn/press/NewsDetail_en.aspx?ColumnId=9&ArticleId=8014

[14] showcased: https://archive.ph/jgj6W#selection-273.54-273.57

[15] engages in classified military research: https://unitracker.aspistrategist.ru/universities/northwestern-polytechnical-university/

[16] has been mulling: https://www.federalregister.gov/documents/2021/10/26/2021-23256/request-for-comments-concerning-the-imposition-of-export-controls-on-certain-brain-computer

[17] is already progressing rapidly: https://cset.georgetown.edu/publication/chinas-advanced-ai-research/

[18] long-term government planning and investment: https://ndupress.ndu.edu/Media/News/News-Article-View/Article/2846343/chinas-new-generation-ai-brain-project/

[19] says: https://archive.ph/P94db

Click here to print.