In 1980 US President Jimmy Carter established the Carter Doctrine, asserting the right of the United States to protect strategic interests in the Middle East. The doctrine reflected the reality that oil sustained the US (and world) economy, and without it economies would collapse. ‘Energy geopolitics’—competition between states for energy security—reflected this worldwide resource race; a race as relevant today as it was in the 20th century.

Today we’re approaching an era where clean energy technology outstrips fossil fuels. This means that there will again be an energy race—but the essential component will be the humble battery. Western tech companies and their Chinese counterparts are competing, and right now Western tech companies are on their own, while Chinese companies have the full backing of their government.

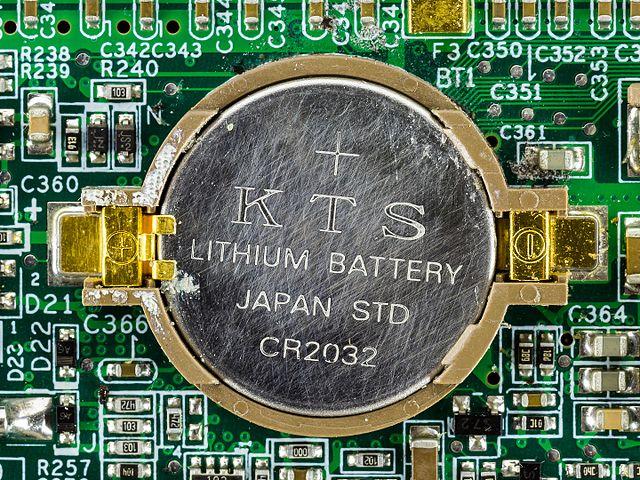

Batteries are essential to all wireless electronic equipment. There are many battery technologies, but lithium-ion batteries are the most widely used in portable electronics. Raw materials account for up to 39% of a lithium battery’s cost. The hardest to obtain is cobalt, one of 27 ‘critical’ minerals. Though it comprises only 10–20% of a lithium-ion battery’s materials, cobalt costs six times more than nickel, the primary component. Cobalt is also ‘scarce’, making it a good case study in what tomorrow’s resource race might look like.

Cobalt has always been rare but several factors have made it even more difficult to access. First, it’s being used more and more. Though we may have reached peak smartphone, advances in renewable energy, electric vehicles, robotics and wireless gadgets depend on expected innovations in battery technology.

Reflecting this demand, it’s anticipated that the still-underdeveloped lithium-ion battery market will grow to US$81.65 billion by 2021. On the supply side, cobalt’s economics are complex, partly because it’s a byproduct of copper and nickel mining, and so dependent on fluctuations in those markets.

Second, and more importantly, political instability makes cobalt vulnerable to supply disruption. The Democratic Republic of Congo (DRC) supplies more than half of the world’s cobalt. Armed conflict plagues 10 of the country’s 26 provinces, and most Congolese earn less than US$1.25 a day. In February The Economist warned that civil war in Congo might resume. President Joseph Kabila presides over a state that Steve Reid quips is ‘neither democratic, nor a republic, nor in control of the Congo’.

In response, Western tech companies are looking to alternative sources of supply, such as Canada. That may pan out. Erich Zimmerman argued that ‘resources are not, they become’. That is, deposits are found as the need arises.

On the other hand, according to South Africa’s Mandini Minerals, for now ‘if you want to become a player in the cobalt market, you need to be in the DRC’. A cursory glance at known cobalt reserves speaks to this point. DRC has 3.4 million tons, with Australia second at 1 million tons. That presents an opportunity for Australia, particularly since we can guarantee uninterrupted supply. But for tech companies, this doesn’t solve the immediate problem of rising demand and prices.

China recognises as much. It has piled investment into DRC even as Western mining companies cut jobs. China, the world’s leading producer and supplier of refined cobalt, imports most of its ore from the DRC. The risk of supply disruption became clear last September when DRC briefly ordered China’s Sicomines to stop exporting cobalt.

But the risk may be overstated. China pursues several stratagems to ensure supply, such as contributing peacekeepers and funding to the UN mission in DRC. In addition, President Kabila has personal ties to China.

China’s cobalt market domination has paid off in the battery market. Chinese battery companies are major players in a sector long dominated by Panasonic and Samsung. CATL is the fastest-growing battery producer in China and dominates the country’s electric vehicle market, which is the world’s largest. By 2020, CATL aims to be the world’s largest battery cell manufacturer.

To succeed, the company must secure supply. Recently it and other Chinese companies signed large contracts with suppliers, stealing a march on their Western competitors. For example, last month a Chinese supplier of battery chemicals signed a deal to buy one-third of Swiss miner Glencore’s cobalt production.

Some Western tech firms are looking elsewhere. Tesla proposes buying only North American cobalt (partially in response to human rights concerns). But the US and Canada produce only 4% of the world’s cobalt, too little to meet Tesla’s ambitions.

Vertical integration is another alternative—gaining control over the supply line, as Alcoa did with aluminium. And Apple wants to buy cobalt directly from Congolese miners. But this is risky, not least because tech companies have little experience with mining and conflict zones.

Whatever they choose, Western companies—and governments—cannot be starry-eyed on this issue. Raw material extraction is the ugly side of technology development, as mining operations and oil extraction across the developing world has shown. Even so, cobalt and other critical minerals will continue to be mined. Leaving lithium-ion batteries aside, cobalt is a ‘high-speed, high-strength wear-resistant alloy’ that’s critical to aerospace and military technology. It can even be used to make bombs.

So if the West loses access to critical minerals like cobalt, it may also lose the energy—and tech—race.

In part two, I will look at options for Western governments.