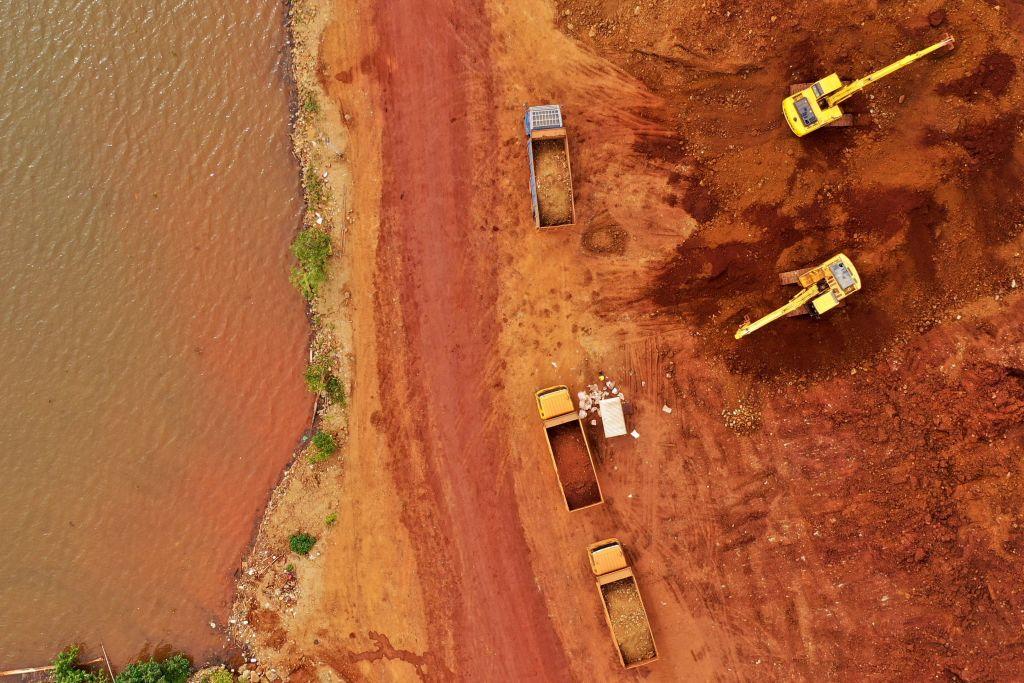

Critical minerals are the bedrock of the global economy, and they are crucial to the advanced capabilities relied on by the world’s top militaries. Metals like copper, nickel and cobalt are ubiquitous in the mechanised world, in everything from aircraft engines and electrical wiring to industrial machinery and electric vehicles. Yet reserves of minerals, and the places where they’re processed, are unevenly concentrated globally.

Given their necessity in the global economy and in the military balance of power, the US must adopt an expanded strategy for securing critical minerals. Complicating this matter, possible sources of critical minerals are in high-risk countries and are mined by non-American companies, often from China.

Indonesia produces 48% of the world’s nickel ore and Chinese companies are expanding their nickel dominance there, investing more than US$14 billion in projects over the past 10 years. Russia produces 17% of the world’s class 1 nickel, which is necessary for electric vehicle batteries, and China produces 20%.

The US holds only 0.4% (370,000 tonnes) of global nickel reserves, and it produces a mere 0.5% (18,000 tonnes) of the world’s nickel ore. The sole nickel-producing mine in the US—Eagle Mine in Michigan—ships its ore overseas for refining and is slated to close in 2025.

Annual US nickel consumption is around 80,000 tonnes, so even if it refined all of its ore production it would still need to import nickel. And even if the US mined all of its nickel reserves, at current reserve levels it would only have enough to last 4.6 years.

The US lacks enough of other critical minerals (such as gallium, graphite, yttrium, bismuth and rare earths) to be self-sufficient and must import them. But its allies also don’t have enough reserves, or don’t mine enough, to meet US demand. The US Geological Survey says China produces 70% of the world’s rare-earth ore, while the US and its allies produce 23%.

The US should be able to rely on its own product and that of its allies to satisfy its demand. But the allies producing rare earths often use them domestically or ship them to China for refining, limiting US access. Australian rare-earths miner VHM Limited, for example, will sell 60% of its output to Chinese rare-earth giant Shenghe.

To secure adequate minerals for its economy and military while it develops domestic production, the US must adopt a critical minerals strategy beyond ‘onshoring’ and ‘ally-shoring’. The government should support American companies financially to help them secure supply agreements with trusted companies, acquire existing overseas mines, and develop new mines overseas. Given the scarcity of experienced, well-capitalised US mining companies, major and junior companies from Canada and Australia should be eligible partners with US firms in this strategy.

A first step would be for the US government to establish a list of companies from which American companies could source minerals—as in manufacturers of rare-earth magnets purchasing oxides from Australian company Lynas’s facility in Malaysia.

Buying existing mines has the advantage that they have proven production, and Canadian and Australian mining companies are already doing this. Australian company Rio Tinto recently secured direct control of Mongolia’s Oyu Tolgoi copper and gold mine. To further reduce supply risk and strengthen economic partnerships, the US government can work with the host country government to identify mines for acquisition, help finance the purchase by US companies, and establish processes to resolve any disputes.

Developing mines costs billions of dollars up front, and securing that capital at reasonable rates, especially for projects in high-risk countries, is difficult. The US government could provide cheap capital for US companies to develop such mines. US companies could partner with Canadian and Australian companies seeking to develop overseas mines, such as BHP, which has invested $40 million in Tanzania’s Kabanga Nickel project.

A US company could identify a project and seek the US government’s financial support and help in negotiating with the host country to secure the mining concessions.