As discussed recently on The Strategist, rumour has it that construction on the Future Frigate program is now unlikely to start in 2020. If true, that’s not a bad thing for completing the systems engineering required to be able to move confidently to the build phase, but it’s certainly going to cause headaches for the management of the shipyard workforce.

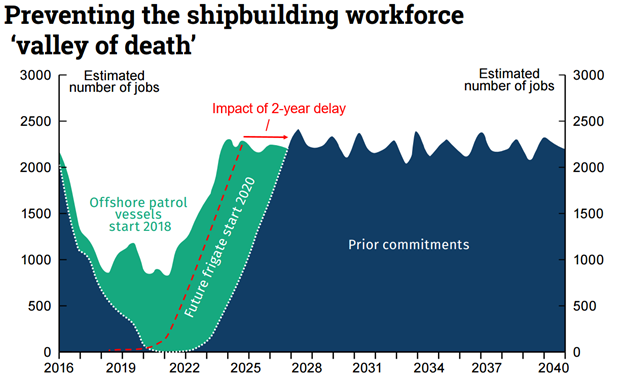

A glance at the graph below shows why. (Thanks to Mark Thomson for the data. He’ll say more about this topic in the forthcoming ASPI budget brief.) Even if there’s no change to the start date of the frigates after all, there’ll still be less than a thousand jobs in the nation’s naval shipyards in the next few years. That compares to over 2,000 working on Air Warfare Destroyers (AWDs) at the start of 2016 and the almost 2,500 expected to be employed when the Future Frigate program is in full swing. A two year delay to the frigates will collapse the number down to a few hundred at most in 2020–21.

Source: Treasury 2016 Budget Booklet ‘Our National Economic Plan’, ASPI annotations in red

That’s unlikely to be a palatable outcome for government. Avoiding the ‘valley of death’ in shipyard jobs was the reason behind moving to a 2020 start date in the first place. And it’s why we have the unobvious decision to split the build of Navy’s Offshore Patrol Vessels (OPVs) over two sites, Adelaide and Henderson WA. Any move in the frigate start date will have the government looking for an alternative strategy for keeping at least a middling amount of shipyard work going in Adelaide.

To see what that might look like, it’s worth going back to the 2014 RAND Corporation report (PDF) on Australia’s naval shipbuilding enterprise, released before the Australian government announced its ‘$89 billion shipbuilding strategy’. That report offered (unconvincing) options for retaining some of the workforce over this period: start future frigate construction before 2020; bridge the gap with OPVs (or patrol boats); or build a fourth AWD. They argued that the additional costs arising from a split build of OPVs would be more than offset by savings from not having to train a new workforce.

If there’s a need for a Plan B, it’s possible that the government might be tempted to build more of the OPVs in Adelaide. But that’s necessarily at the expense of work in Western Australia, and that will have its own political costs. Or they could even commission work in the yards that isn’t currently programmed (or needed).

We think that there’s a better option than further distorting the OPV plan or confecting busy work. The contract for the Hobart-class AWDs included an option for a fourth vessel, though there was no Navy requirement for it. The notion of a fourth AWD slowly faded away, and the number of Future Frigates quietly increased from a notional eight to a program of nine. We wouldn’t suggest that the government force a ship on RAN that it doesn’t need. The Future Frigate program has an anti-submarine warfare (ASW) emphasis and it makes sense to bolster the Navy’s ASW capability given a region increasingly full of submarines.

But submarines aren’t the only regional security threat. We think there’s a fairly robust argument for acquiring a fourth AWD aside from the industrial benefits of continued ship production. Ballistic missile defence (BMD) is a live topic, thanks to continuing North Korean missile tests. If Australia is looking to do more to help the US, Japan and South Korea defend against North Korean ballistic missiles, the most useful capability the ADF can expect to contribute in the near future is a BMD-capable warship. As a bonus that would provide a measure of defence against anti-ship ballistic missiles, which are emerging as a threat to surface vessels.

The three AWDs in the process of delivery are equipped with the US-made Aegis combat system. Newer builds of Aegis have an optional BMD module, but Australia’s three won’t be upgraded to be BMD capable until the mid-2020s (if then). As detailed in an ASPI report last year, an upgrade to the newest version of Aegis (Baseline 9), including the BMD module, might cost about US$125m per vessel (plus the cost of BMD-capable missiles). But, more significantly, the upgrades could take each vessel out of service for an extended period.

A fourth AWD could deliver the RAN a BMD capability in the early 2020s, with no disruption to the availability of the first three. It might even be possible to fit BMD to the third vessel currently under construction. Depending on availability of long lead-time items, Australia could order two sets of Aegis Baseline 9 and BMD systems and install one set on the third AWD rather than the outmoded Baseline 8 system that will be replaced in a few years anyway. There’d be an additional cost in the short term, but would avoid the cost of upgrading it later. Australia could add BMD to the third AWD regardless of whether there’s a fourth AWD, but two BMD ships are better than one, since one has to be offline at times for maintenance.

A fourth AWD would provide more jobs in South Australia than the split OPV build will. And, as a bonus, all of the OPVs could be built in Western Australia, with no disruption to the build due to moving sites. Remember, you read it here first.