Late last year, as the bilateral relationship between Australia and Indonesia struggled with the revelations of the spying scandal, Colin Brown, an adjunct professor at the Griffith Asia Institute, described the history of the relationship in a carnival metaphor:

Late last year, as the bilateral relationship between Australia and Indonesia struggled with the revelations of the spying scandal, Colin Brown, an adjunct professor at the Griffith Asia Institute, described the history of the relationship in a carnival metaphor:

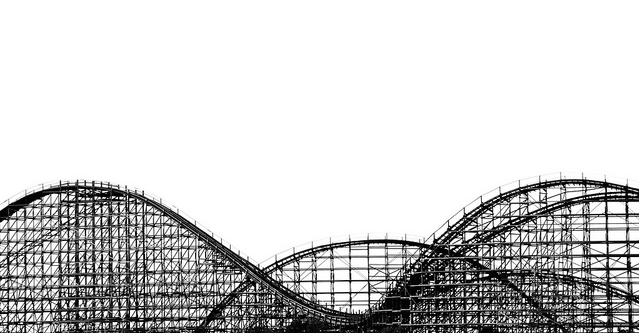

For anyone interested in Australia–Indonesia relations, nothing so characterises the phenomenon as a car on a roller-coaster. Any rise is followed inevitably by a fall. The ride is never boring, and in a bizarre kind of way it is quite predictable. But sometimes you might hope for a little more stability, a few more moments of calm.

That image of the roller-coaster is an old one—Brown himself has used it before. Indeed, it’s been around long enough (and been true long enough) to induce a weariness in even the most determined optimist. But in this post I’m hoping to convince readers that, strategically, there’s still much to play for here.

Let’s start by looking at Southeast Asia. The table below, constructed from the publicly-available data in the CIA World Factbook, provides a quick economic snapshot of the ASEAN countries based on 2013 estimates. I’ve appended Australia at the bottom of the list just to give a sense of relative economic size.

If we look at the ASEAN figures first, it’s obvious that ASEAN isn’t a collection of evenly-sized economies. If we focus on the purchasing-power-parity measurement of GDP, we see in ASEAN one large economy (Indonesia), five middle-sized economies (Thailand, Malaysia, the Philippines, Singapore and Vietnam), and four dwarves (Myanmar, Cambodia, Brunei and Laos).

| GDP (US$)(PPP) | GDP (US$)(Official Exchange Rate) | Real growth rate | Per capita (US$)(PPP) | |

| Brunei | $22.25bn | $16.56bn | 1.4% | $54,800 |

| Cambodia | $39.64bn | $15.64bn | 7% | $2,600 |

| Indonesia | $1,285bn | $867.5bn | 5.3% | $5,200 |

| Laos | $20.78bn | $10.1bn | 8.3% | $3,100 |

| Malaysia | $525bn | $312.4bn | 4.7% | $17,500 |

| Myanmar/Burma | $111.1bn | $59.43bn | 6.8% | $1,700 |

| Philippines | $454.3bn | $272.2bn | 6.8% | $4,700 |

| Singapore | $339bn | $295.7bn | 4.1% | $62,400 |

| Thailand | $673bn | $400.9bn | 2.9% | $9,900 |

| Vietnam | $358.9bn | $170bn | 5.3% | $4,000 |

| Australia | $998.3bn | $1,488bn | 2.5% | $43,000 |

Compared with the ASEAN countries, Australia’s economy is poised between Indonesia’s and Thailand’s. It’s not really like Thailand’s, though, and we can see that by looking at the GDP estimates based on official exchange rates, where’s Australia’s economy is three-and-a-half times the size of Thailand’s. So the two dominant economies in Southeast Asia are Indonesia’s and ours. Between us, we have the first requirement for a meaningful partnership: shared economic strength.

We also have something else that might empower a strategic partnership—a set of complementarities. Analysts often say the relationship has no ‘ballast’; that it’s all sail and no rudder, regularly blown off course by the winds of public opinion. Turning the issue around, though, we have an opportunity to nurture a set of complementarities with Jakarta: we’re a developed economy with a small population and good contacts in the Western world; they’re a developing economy with a large population and good contacts in the Islamic and non-aligned worlds. Those complementarities could form the basis for a genuine partnership—if will exists in both capitals to pursue one.

A third driver of a strategic partnership is a shared sense of strategic transformation: we both live in a region that’s having strategic significance thrust upon it. That’s important. Previously we’ve had plenty of scope to rehearse our differences at the regional level. But with more great powers wanting to play in Southeast Asia’s space these days, we share an interest in nurturing what the Indonesians would call ‘regional resilience’ and what we might call ‘a Southeast Asian power core’.

So far, I’ve put a positive spin on a future partnership. So why don’t we have one? Three reasons. First, the drivers I’ve pointed to above are all abstract. In the reality of everyday events—like boat people, live cattle exports, spying scandals, and drug trafficking incidents—abstract similarities get lost. Second, the complementarities that I identify arise because we’re so different. As Gareth Evans and Bruce Grant observed in their work Australia’s Foreign Relations, ‘No two neighbours anywhere in the world are as comprehensively unalike as Australia and Indonesia’. And third, there’s the issue of priorities. Neither of us prizes a partnership highly enough to make it work. That might be changing. In 2013 we had a conservative political leader campaigning on the slogan of ‘more Jakarta, less Geneva’—but then again Geneva’s never ranked that highly in Australian strategic policy.

So where does that leave us? It means we’ll have a stronger strategic partnership in the future, but it’s as likely to grow from a policy of muddling through as it is from a policy of strategic design. If we want to push a particular design of a partnership, we’re going to have to put heavyweight political muscle behind it. On occasion, the Abbott government does signal that it’s prepared to do that. Still, others have been here before. Paul Keating made a serious effort to improve a relationship he saw as ‘a thin foreign policy crust covering a disappointingly hollow core’. The important difference this time round is Asian transformation: if that doesn’t drive us to work more closely together, I suspect nothing will. It’s do-or-die time for the Australian–Indonesian strategic partnership.

Rod Lyon is a fellow at ASPI and executive editor of The Strategist. Image courtesy of Flickr user Alexis Gravel.