The six-month temporary agreement between Iran on the one hand and US, UK, France, Germany, Russia and China on the other is rapidly running out. The Joint Plan of Action (JPA) took effect on 20 January, and therefore expires on 20 July. The JPA is renewable by mutual consent, so no great drama necessarily ensues in late July. But readers might like a quick summary of what’s happening.

The six-month temporary agreement between Iran on the one hand and US, UK, France, Germany, Russia and China on the other is rapidly running out. The Joint Plan of Action (JPA) took effect on 20 January, and therefore expires on 20 July. The JPA is renewable by mutual consent, so no great drama necessarily ensues in late July. But readers might like a quick summary of what’s happening.

In truth, reports of the negotiations paint a confused picture about how much progress is being made towards a comprehensive agreement. Iran’s insistence on being able to manufacture sufficient low-enriched uranium to avoid a reliance on foreign suppliers for nuclear fuel is clearly a major sticking point. Much depends on how the parties eventually define Iran’s ‘practical needs’ for enrichment technology. But if those needs include the capacity to supply fuel for the current reactor at Bushehr and other planned reactors there, Iran would need centrifuges in the tens of thousands. Iran’s nuclear chief has estimated it would need 50,000 centrifuges, which is about 30,000 more than it has now. Somehow, I don’t think that’s going to fly.

Since needs aren’t wants, the key question is just how self-reliant do the Iranians need to be? The logical place to source fuel for Bushehr is Russia, which already has the contract to supply the current reactor until 2021. So the self-reliance claim might be merely a negotiating tactic, intended to wrest concessions from the great powers. For their part, the great powers are probably willing to live with an enrichment capability that might allow for a few thousand closely-monitored centrifuges, but 50,000 is right out of the ballpark. A comprehensive agreement can’t allow Iran a breakout capability that would let it quit the NPT (like North Korea did back in 2003) and move quickly down the road to nuclear weapons.

Over at the Foreign Policy journal, Jeffrey Lewis insists the real problem isn’t Iran’s having the capacity to refuel Bushehr, but the possibility of hidden facilities—because those would fall outside IAEA monitoring. In truth, both capacities should be cause for worry. Obviously, a small, covert facility would let Tehran manufacture and hoard small stocks of enriched uranium. But a large number of centrifuges supporting an open civil program, and providing the basis to enrich uranium relatively quickly, would always be something of a worry while fissile material remains the long pole in the proliferation tent.

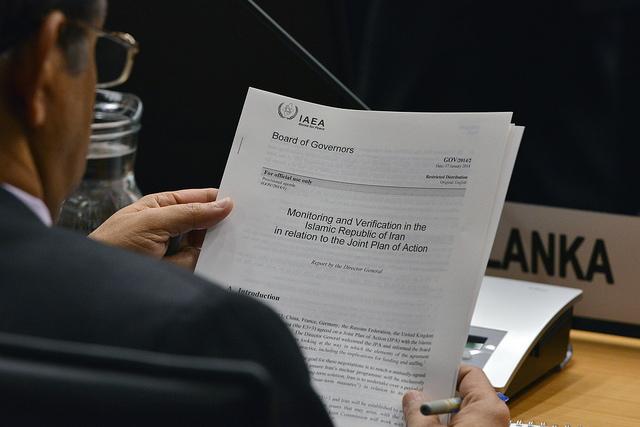

There’s a parallel set of negotiations underway between Iran and the IAEA, intended to resolve outstanding questions about the Iranian nuclear program in earlier years. So far, the degree of Iranian cooperation with the IAEA to resolve those concerns—including questions about the extent of Iranian weaponisation efforts, for example—is variable. The IAEA Report on Iran (dated 23 May, but ‘derestricted’ only on 4 June) is cautiously phrased. The overall tone of the Executive Summary suggests Iran is making a serious effort to meet designated targets. The stock of uranium enriched to 20%, for example, has fallen dramatically, though the quantity of uranium enriched to 5% continues to rise as Iran steadily builds that part of its inventory.

But the detail of the report (see paras 53-59, for example) suggests Tehran still has some way to go to answer questions about the possible military aspects of its nuclear program. True, Iran has shown some willingness to discuss the issue of exploding bridgewire detonators, which it argues were tested with a civilian application in mind. But other questions remain. And there’s debate about the level of transparency that Iran is showing. Metrics about transparency aren’t as clear-cut as they are on enriched-uranium quantities—after all, how much detail is enough to satisfy the IAEA’s concerns?

The picture is also murky away from the negotiating room. The Iranian supreme leader says, in public, that the US has taken ‘off the table’ the option of using military force to resolve the Iranian nuclear issue. (What President Obama actually said was ‘We reserve all options to prevent Iran from obtaining a nuclear weapon’.) What’s Ayatollah Khamenei doing? Is he intending to reassure hardliners within Iran that a bargain can be struck with the great powers that dismantles the sanctions regime against Iran but doesn’t expose it to new threats? If so, the statement could be read as Khamenei freeing President Rouhani’s hands in a bid to reach a final settlement, but the evidence is too mixed to be persuasive. The recent US deal with the Taliban over POWs—and the inequitable trade therein—might be hardening opinion in Tehran against further concessions.

It’s always difficult to make judgments about how well negotiations are going from outside the negotiating room. At this point, the most likely outcome is a renewal of the six-month bargaining period. Precipitate agreement on a comprehensive deal looks unlikely. But so too does a breakdown in the talks—no-one’s talking about walking away. What’s becoming clearer is that even a final agreement will leave Iran with some breakout capability—and one of the key issues is whether that capability will be small or large.

Rod Lyon is a fellow at ASPI and executive editor of The Strategist. Image courtesy of Flickr user IAEA Imagebank.