Will China regress to the mean?

Posted By Charles Miller on October 27, 2014 @ 12:15

[1]Fans of English Premier League soccer may be aware of the phenomenon known as the ‘Manager of the Month’ effect. According to that, a team’s performance tends to drop the month after its coach has been given the ‘Manager of the Month’ award. Some say it’s because the winner grows overconfident and slips up. However, as the London Times sports columnist Danny Finkelstein points out, it’s actually just a reflection of a statistical phenomenon known as ‘regression to the mean’. A month is a short period in soccer and so it’s likely that a manager who did well in such a time frame is simply lucky and all that happened is that the following month his (it’s always ‘his’ in the EPL) luck ran out [2].

[1]Fans of English Premier League soccer may be aware of the phenomenon known as the ‘Manager of the Month’ effect. According to that, a team’s performance tends to drop the month after its coach has been given the ‘Manager of the Month’ award. Some say it’s because the winner grows overconfident and slips up. However, as the London Times sports columnist Danny Finkelstein points out, it’s actually just a reflection of a statistical phenomenon known as ‘regression to the mean’. A month is a short period in soccer and so it’s likely that a manager who did well in such a time frame is simply lucky and all that happened is that the following month his (it’s always ‘his’ in the EPL) luck ran out [2].

Now what does this have to do with China? Well, former US Treasury Secretary Larry Summers and fellow Harvard economist Lant Pritchett have just written a paper [3]—described by Marginal Revolution’s Tyler Cowen as ‘one of the best and most important economics papers I’ve seen all year [4]’—suggesting that regression to the mean is exactly what’s most likely to happen to the Chinese economy. Analysing decades of statistical evidence on economic growth, they note that the best predictor of how much a country will grow in future isn’t its current growth rate, rather the global average growth rate. Expansions as rapid and as sustained as China’s are historically rare. Most countries which are highly developed today got there by posting solid and moderate but sustained economic growth over a long time frame (the US, Britain, Denmark). Many lower income countries by contrast have hosted spectacular booms over a couple of decades, followed by busts which undo many of the gains (Brazil being one example).

Economic predictions, don’t have a great track record (though I argue they’re getting better [5] and Summers himself is better than most [6]). Moreover, even the best predictions are probabilistic rather than deterministic. Maybe there’s something about China that our growth models aren’t capturing which will allow it to keep on expanding at a rapid clip. Summers and Pritchett limit themselves to concluding that the ‘burden of proof’ should lie with those who believe it’ll continue to post the current spectacular growth rates and not those who forecast a more modest trajectory.

But as far as I’m aware, the main ‘China-specific’ factors are also pointing in a bearish direction. The ageing population is one well known factor [7], as is the possibility of radical political change (more of which below). What could be even more important though is the lack of strong property rights (a point also made [8] by MIT’s economists Daron Acemoglu and James Robinson). Property rights are increasingly being seen as the key to long-term economic growth in the developing world because they give entrepreneurs the assurance that their hard work, innovation and risk taking will be appropriately rewarded. Unfortunately, China currently falls down rather badly on that score.

Summers and Pritchett’s argument is convincing. If China’s growth does revert to the mean, what might the consequences be for Asia-Pacific security? Pessimists such as my dissertation chair Peter Feaver argue [9] that ‘a weak China could be just as vexing as a strong China’. The CCP could, for instance, engage in overseas adventurism to bolster its flagging popularity. However, the empirical evidence that such ‘diversionary wars’ happen isn’t strong [10]. More likely, a China which reverted to the mean global growth rate, while bad for the global economy, could be good for global security. It would give its neighbours fewer incentives to engage in arms build-ups. Moreover, if China also transitions towards democracy (which Summers and Pritchett suggest as a likely reason why its growth could slow), then it would be still more reassuring to outsiders.

A future which includes a slower growing, democratic mainland China may be less prosperous and more banal, but also less insecure. Perhaps we’re not cursed to live in interesting times after all.

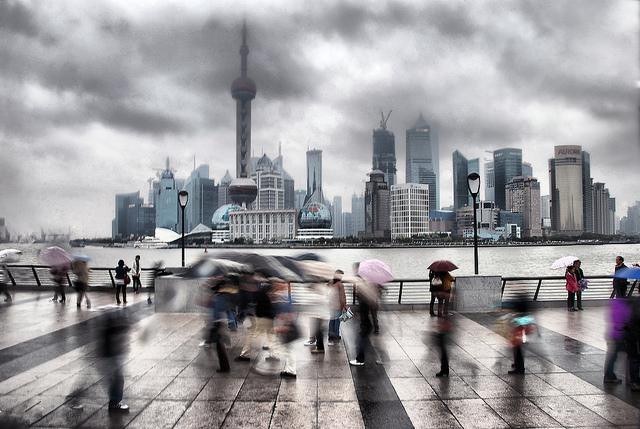

Charles Miller is a lecturer at ANU’s Strategic and Defence Studies Centre. Image courtesy of Flickr user 蜡笔 MR [11].

Article printed from The Strategist: https://aspistrategist.ru

URL to article: /will-china-regress-to-the-mean/

URLs in this post:

[1] Image: https://aspistrategist.ru/wp-content/uploads/2014/10/4534686340_93656e5d1e_z.jpg

[2] luck ran out: http://www.thetimes.co.uk/tto/sport/football/finktank/article4636.ece

[3] written a paper: http://www.frbsf.org/economic-research/events/2013/november/asia-economic-policy-conference/program/files/Asiaphoria-Meet-Regression-to-the-Mean.pdf

[4] one of the best and most important economics papers I’ve seen all year: http://marginalrevolution.com/marginalrevolution/2014/10/some-of-the-most-important-sentences-in-economics.html

[5] they’re getting better: http://www.tandfonline.com/doi/full/10.1080/10357718.2014.899308#.VEcEkfmUcpU

[6] better than most: http://www.nytimes.com/2009/03/29/business/economy/29view.html?partner=rss&emc=rss&_r=0

[7] one well known factor: http://www.theguardian.com/world/2012/mar/20/china-next-generation-ageing-population

[8] made: http://whynationsfail.com/

[9] argue: http://www.rooseveltroom.net/feaver-chinese-regime-scared-of-banality/

[10] isn’t strong: http://www.sup.org/book.cgi?id=18173

[11] 蜡笔 MR: https://www.flickr.com/photos/_4gb/4534686340

Click here to print.